SAP S/4HANA 2020: Bank Account Processing with Bank Reconciliation Accounts

Introduction

Up until the SAP S/4HANA 1909 version, when creating a new house bank account we would create a new G/L account as the main bank GL account. We would create Sub-GL accounts to be able to process payments and receipts and Reconciliation process either automatically or manually.

In SAP S/4HANA 2020, we can follow a new procedure. In this new version, we can create bank reconciliation accounts (Main Bank Account) that can be assigned to multiple house bank accounts. We can assign this to all relevant new house bank accounts that we create in the system. This helps to simplify payment processes and to cut down on the number of G/L accounts needed by creating just one bank. A General Ledger account with new GL Type (C) can be assigned to multiple House banks accounts. Therefore we can minimize GL Accounts by assigning one GL account for Multiple House banks.

Old Method Vs New Method

Old method – until SAP S/4HANA 1909

We used to create a new set of G/L accounts each time you needed to connect to a new house bank account.

We used to have a different main bank account for each House bank Account and similarly different set of Bank Clearing Accounts

SAP S/4HANA 2020

In SAP S/4HANA 2020, There are two ways of creating the required sets of G/L accounts. You can follow either the new method or the old method.

1. One set of G/L accounts for one House bank account (Old Method)

2. One set of G/L accounts for multiple House bank accounts (New Method)

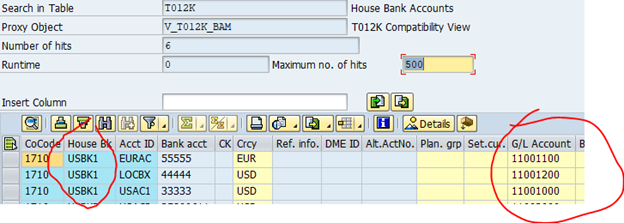

As per the new method, we can create a bank reconciliation account (Main Bank Account) that can be assigned to multiple house bank accounts. In this example, we can create only one GL Account like 11001100 instead of three Main GL accounts and assign the same to all three House banks

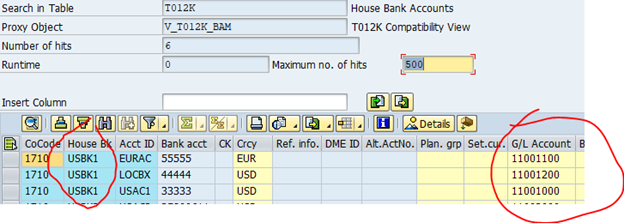

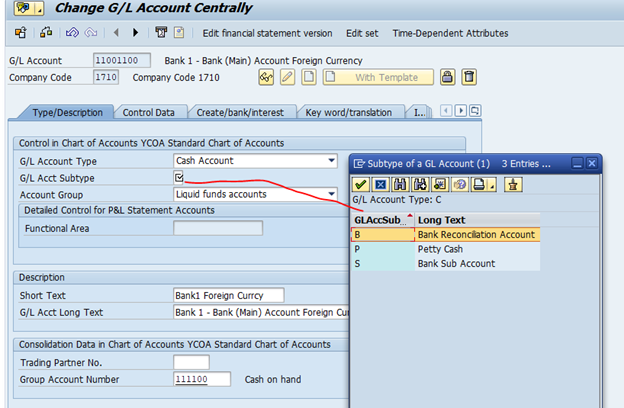

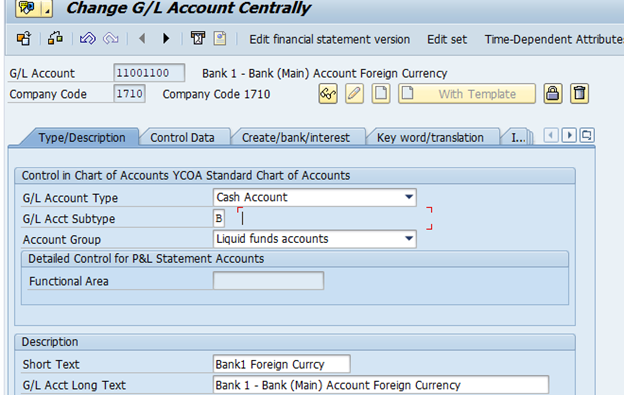

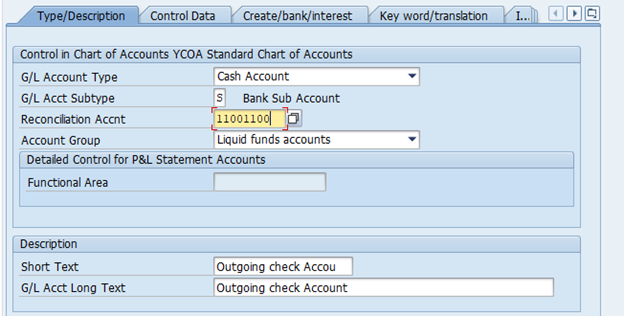

Before you assign a bank reconciliation account (Main Bank Account) to a house bank account, make sure that you have created the G/L account with the type Cash Account and subtype Bank Reconciliation Account.

For this bank reconciliation account (Main Bank account 1100100), we can create and assign bank clearing accounts for each of your payment methods. Similarly, we will be able to use the same GL Accounts (Main Account, Bank Reconciliation Account and Sub-GL Accounts) for the new House banks we may create in the future. Under this method, a new GL Account type can be found in FS00.

The New Account Type is ' Cash Account.' The main Bank account 11001100 in this example, must be created under this account type (Cash Account) with option B out of three three options shown in the pop-up window screen.

Bank Sub Accounts (Clearing Accounts) should be created using 'S'

We have to give the Main Bank GL account number in the Clearing GL account as shown above.

There are two ways to create GL accounts in S/4HANA 2020. Either you create balance sheet accounts as shown previously, or you use special cash accounts – that is, bank reconciliation accounts. If you use bank reconciliation accounts for the house bank connection, one set of G/L accounts can be sufficient for multiple house banks. If you create balance sheet accounts for the house bank connection, you need to create a new set of G/L accounts each time you need to connect to a new house bank account. For each payment method that you require, create a clearing account (bank subaccount):

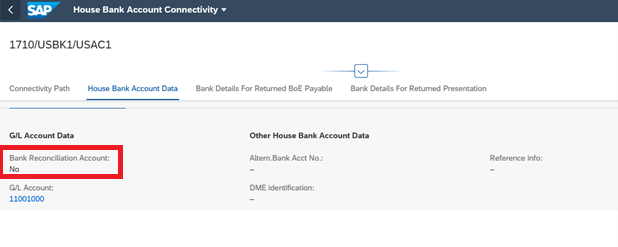

App: Manage Bank Accounts > Connectivity Path > Connectivity path the status must be Reconciliation Account 'Yes', If the Status is NO, it works as the old design.

Use special cash account that is bank reconciliation accounts. We use this cash account (bank reconciliation accounts) for assigning to the House bank. Using this new method of configuration, one set of G/L accounts can be enough for multiple house banks.

Basic Configuration settings:

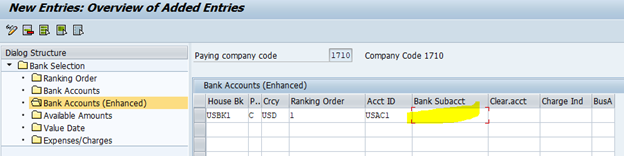

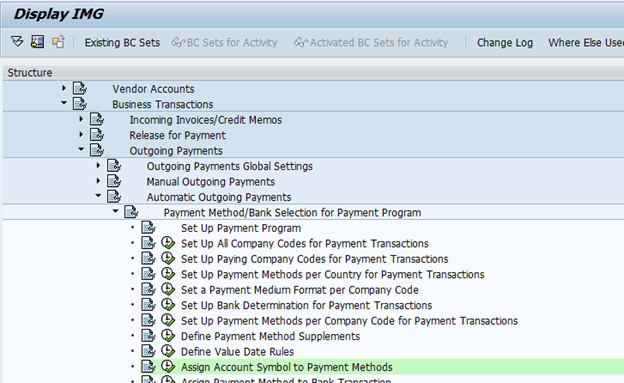

Transaction Code: FBZP

Leave Sub-GL Account Blank

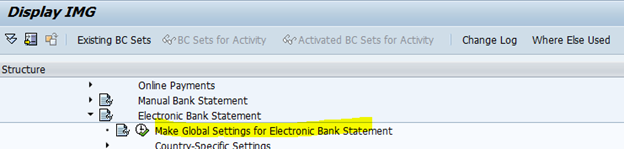

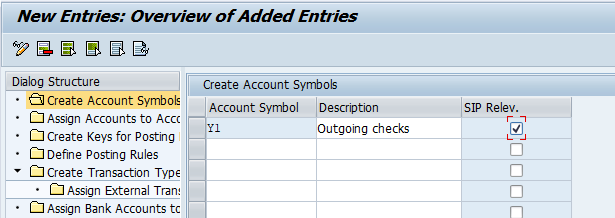

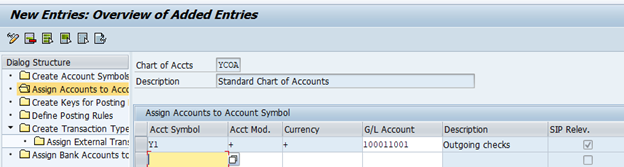

Make Global Settings for Electronic Bank Statement

GL Account 'Outgoing checks' is Bank Clearing Account that is created as Open item Management account. The Check Box ( SIP) should be opted.

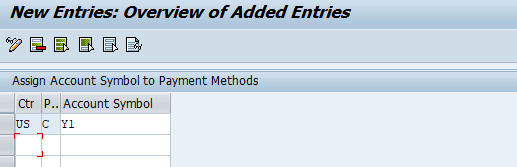

Assign Account Symbol to Payment Methods

Migrate G/L Accounts

We must migrate GL accounts to replace existing G/L accounts that have been assigned to house bank accounts to bank reconciliation accounts.

First create a GL account in FS00 under target G/L account type C (that is, the GL account to which you want to transfer the balances). It is a main bank account (Bank Reconciliation account in SAP S/4HANA 2020).

Steps to Migrate:

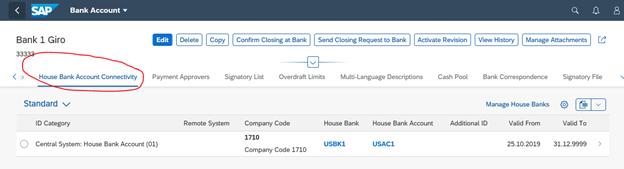

In the Manage Bank Accounts app, go to the House Bank Account Connectivity tab

Select the house bank account connected to the G/L account (type X) from which you want to migrate the balance. In the House Bank Account Data section, choose Migrate G/L Account.

This changes the status of the house bank account to In Migration. Enter the G/L account number of the newly created G/L account (type C) in the Target Bank Reconciliation Account field. Now Save.

Then, start the actual balance migration to the G/L accounts (type C)

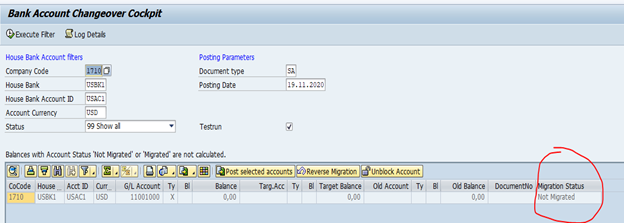

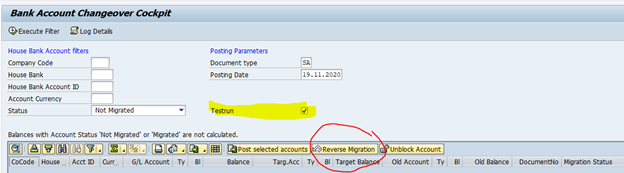

Transaction Code: FB_MIG_HBA_COCKPIT

Search for the G/L accounts (type X) from which you want to migrate the balances. Make sure that their status is In Migration as otherwise the system can't migrate their balances.

Select one or more G/L accounts and choose Post selected account.

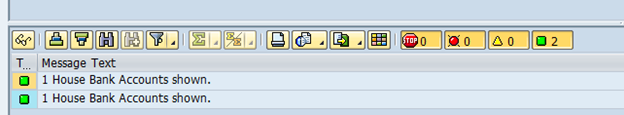

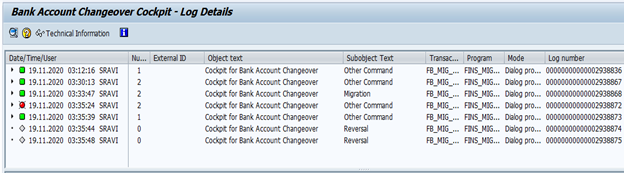

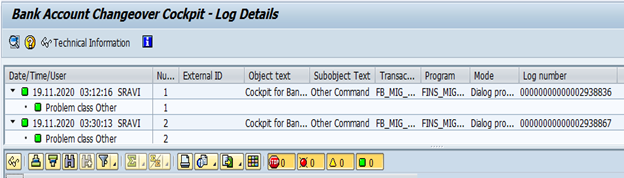

Once we execute Migration, you can see status in the log as below:

During migration, make sure not to post any transactions. This because the system blocks the concerned G/L accounts for postings to prevent any inconsistencies.

After the migration is completed and all open items have been cleared on the related G/L accounts that represent the clearing accounts, go back to the Manage Bank Accounts app. In the House Bank Account Data section of the relevant house bank account, choose Finalize G/L Account Migration. This sets the bank account status to Migrated.

You can also undo a migration. To do this, choose Reverse Migration.

Before you start the update run, we can run as a test run first.

About the Author:

Dr. Ravi Surya Subrahmanyam is a technical and Financials writer with a background in SAP Financial Accounting, Funds Management, Group Reporting, Financial Supply Chain Management, Cash Management & in-house cash, SAP S/4 HANA Finance. He has been working as a Director for the SAP Practice for The Hackett group India Ltd, (Answerthink Company). He completed his Master's degree in Finance from Central University, Master of Commerce from Osmania University, Master of Commerce from Andhra University, and Ph.D.in Finance from one of the best universities in India. His research Papers have been published in National and International magazines. He has been a Visiting Instructor for SAP India Education and SAP Indonesia – Education. He has been working on Conversion and Upgradation projects. He is a Certified Solution Architect for SAP S/4 HANA and an SAP S/4 HANA Certified Professional. He can be reached at sravi@answerthink.com or fico_rss@yahoo.com

Stay tuned for more insights on Eursap's Blog…

Please also check out Eursap's weekly SAP Tips!

Need to hire SAP Consultants?

Get in touch with Eursap – Europe's Specialist SAP Recruitment Agency

How to Create Reconciliation Account in Sap Fico

Source: https://eursap.eu/2020/12/10/blog-sap-s-4hana-2020-bank-account-processing-with-bank-reconciliation-accounts/

No comments:

Post a Comment